do nonprofits pay taxes on utilities

Individuals businesses and groups must pay use tax on their taxable purchases. Property Tax Rates Explained.

Recurring Autopay Utility Payments And Services Citybase

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

. Non-Profits Can Be Exempt From Property Taxes Pressured to Pay PILOTs. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain. While most US.

For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses. Do nonprofits pay taxes. In some cases nonprofits that are exempt from property taxes may also be exempt from municipal and county fees such as those for water and sewer.

Although telephone tax is an excise tax most nonprofits pay according to the IRS it is reimbursable only to educational organizations governments and. However here are some factors to consider when. Yes nonprofits must pay federal and state payroll taxes.

501c12 Tax exempt Income from memberships to 501c12 co-op utility providers is not considered UBTI and is tax exempt. However it might still have to pay local property and sales. Local governments of some places provide services to non-profits even though they dont pay property taxes.

The methods of compensation vary from place to place. Do nonprofit organizations have to pay taxes. However here are some factors to consider when.

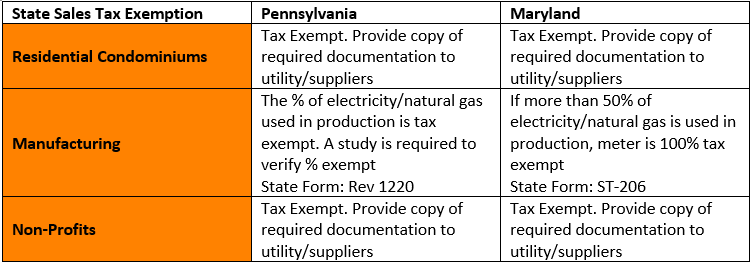

Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from utility. Services to General Public Taxable If your. The state use tax is complementary to and mutually exclusive of the state sales tax.

Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. For assistance please contact any of the following Hodgson. Depending on the amount of.

Do nonprofit organizations have to pay taxes. Unlike businesses nonprofits organizations are exempt from federal income taxes under subsection 501 c3 of the Internal Revenue Service IRS tax code. A non-profit corporation may be exempt from paying federal and state income tax payroll taxes and property taxes.

In short the answer is both yes and no. The research to determine whether or not sales. UBI can be a difficult tax area to navigate for non-profits.

However this corporate status does not. The nations average rate is. We know that property taxes are taxes that local governments impose on property owners to pay.

Do nonprofits pay payroll taxes. Most nonprofits do not have to pay federal or state income taxes. Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated.

The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation. Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate. Most nonprofits do not have to pay federal or state income taxes.

Your recognition as a 501c3 organization exempts you from federal income tax. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals and other nonprofit organizations are exempt from state sales tax on.

![]()

For People Behind On Utility Bills A Vicious Circle Of Red Tape The Land

Call 211 Texas For Utility Assistance To Help You Pay The Light Bill

Houston Utility Assistance Find Help To Pay Your Light Bill 2021

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Payment Kiosks For Utilities And Government Citybase

Utility Users Tax Public Agency Accounts Spurr

Revenue Department Clarifies Tax Exempt Sales Notice Alabama Retail Association

3c Creative Communications Consulting Home Facebook

Housingfinanceafrica Cahf Africa Twitter

Transportation Utility City Of Wisconsin Rapids

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Providing Essential Utility Services During Covid 19 Payments And Relief

Lawrence Utilities Launches User Profile For Easier Web Payments

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc

Electric Utilities Sector Supplement Global Reporting Initiative

Tax Exemptions For Energy Nania