city of richmond property tax rate

Building Department. Parking Violations Online Payment.

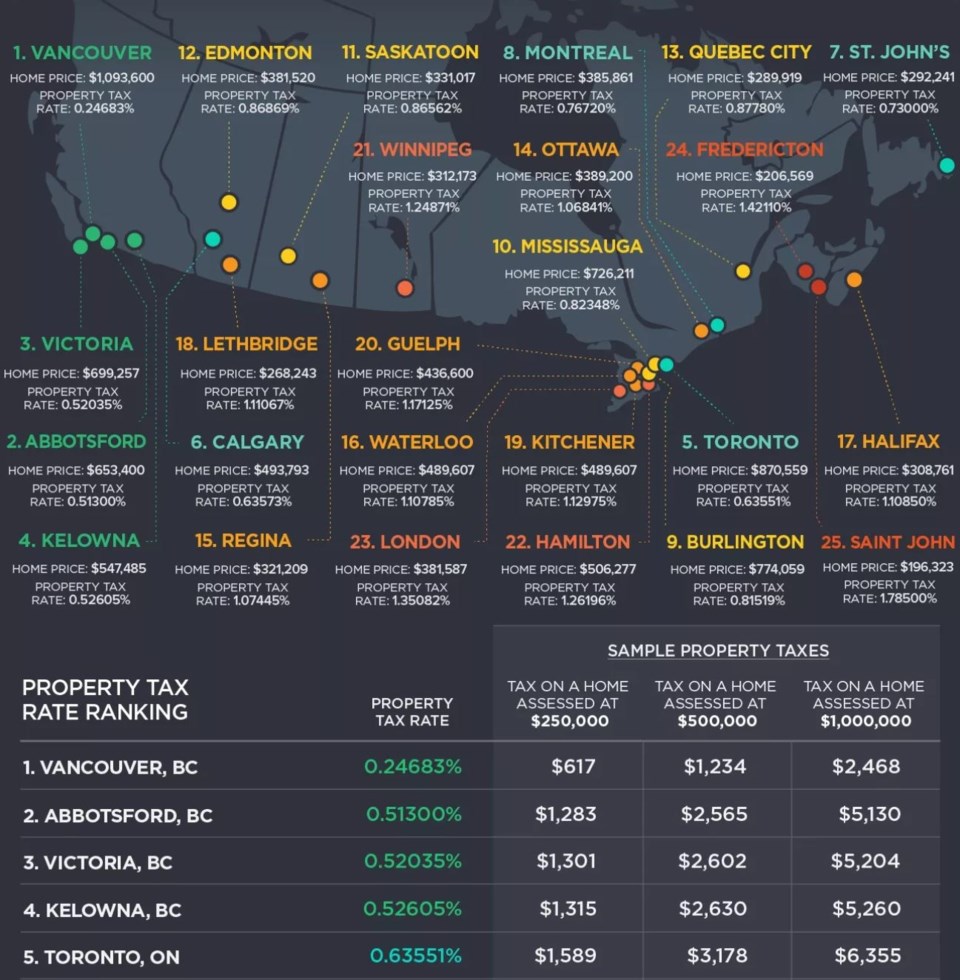

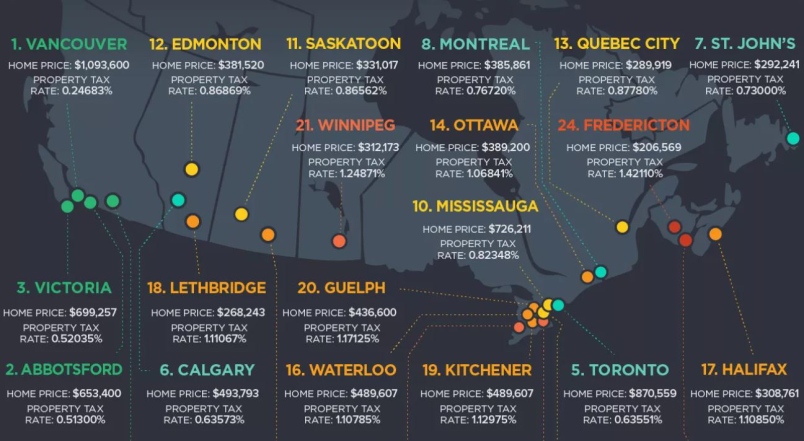

Ontario Property Tax Rates Lowest And Highest Cities

401-539-1089 Staff Directory Helpful Links.

. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th. 350 per 10000 assessed value First half due June 5th second half due December 5th. To pay your 2019 or newer property taxes online visit the Ray County Collectors website.

Vehicle License Tax Motorcycles. 4 rows Residential Property Tax Rate for Richmond from 2018 to 2021. Year Municipal Rate.

The new assessments will be used to calculate tax bills mailed to city property owners next year. This has also led to property tax rates of 120 per hundred in Richmond while neighboring Henrico County residents pay 085 per hundred. If you have an issue or a question related to your personal property tax bill call RVA311 by dialing 311 locally visit.

Click Here to Pay Parking Ticket Online. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in.

Richmond City Finance Department 900 E. Vehicle License Tax Vehicles. Ad Uncover Available Property Tax Data By Searching Any Address.

815 am to 500 pm Monday to Friday. County schools it is 12000. Colleen Cargo City Assessor Email Richmond City Hall 36725 Division Road Richmond MI 48062 Ph.

City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456. City of Richmond adopted a tax rate. The Personal Property Tax rate is 533 per 100 533 of the.

Call 804 646-7000 or send an email to the Department of Finance. May 1st Real Estate Tax Rate. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

Rhode Island Emergency Management Agency. Search by Property Address Search property based on street address If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000. Personal Property Taxes.

Greater Vancouver Transportation Authority TransLink 604-953-3333. Virginia Department of Taxation For additional forms or information on other tax related items please contact the Virginia Department of Taxation at 1-804-367-8031. It is estimated that by freezing the rate the city will provide Richmonders more than 8 million in additional relief.

Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. Pay Real Estate Tax. Offered by City of Richmond Virginia.

This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc. Parking tickets can now be paid online. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate.

Pay Your Parking Violation. Real estate taxes are due on January 14th and June 14th each year. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

What is considered real property. Yearly median tax in Richmond City. Broad St Rm 802 Richmond.

What is the due date of real estate taxes in the City of Richmond. Richmond City Assessors Office 900 E. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector.

Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. All City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to. 370 per 10000 assessed value Due.

If you are looking for information for the City of Richmond please click here. The real estate tax rate is 120 per 100 of the properties assessed value. 138 per 10000 assessed value Total amount due by June 1st penalty is 10 of tax bill Henrico County.

Personal Property Tax Rate. Now the schools are over 85 minority students and the spending per pupil is close to the 20000 per year mark. 2 days agoAs Richmond residents see an increase in their Personal Property Tax bills Mayor Levar Stoney is requesting that the due date for the payments be extended.

City Council will host a special. City Of Richmond Personal Property Tax Rate. Real property tax on median home.

2021 Richmond Millage Rates. Tax rates differ depending on where you live. Richmonds real estate tax rate is 120 per 100 of assessed value.

What is the real estate tax rate for 2021. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. We Provide Homeowner Data Including Property Tax Liens Deeds More.

Vehicle License Tax Antique. 10 Homes Make an Outdoor Connection. Municipal Finance Authority 250-383-1181 Victoria.

Car Tax Credit -PPTR. 3 Road Richmond British Columbia V6Y 2C1 Hours. For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at.

To view previous years Millage Rates for the City of Richmond please click here. Real Estate and Personal Property Taxes Online Payment. Real Estate Taxes.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. 1 day agoWhen this spending plan for the fiscal year that starts July 1 was first proposed it would have added 80 cents to the citys share of the property tax rate bringing it. These documents are provided in Adobe Acrobat PDF format for printing.

Toronto Property Taxes Explained Canadian Real Estate Wealth

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

Lower Mainland 2022 Property Assessments In The Mail

About Your Tax Bill City Of Richmond Hill

Mississauga Boasts 11th Lowest Property Tax Rate In Ontario Insauga

Ontario Property Tax Rates Lowest And Highest Cities

City Of Richmond Adopts 2022 Budget And Tax Rate

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

Residential Property Tax Calculator

Vermont Property Tax Rates Nancy Jenkins Real Estate

Where Do I Find My Folio Number And Access Code Myrichmond Help

About Your Tax Bill City Of Richmond Hill

Ontario Cities With The Highest Lowest Property Tax Rates October 2022 Nesto Ca

Here S How Mississauga S Property Taxes Compare To Other Ontario Cities Insauga

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

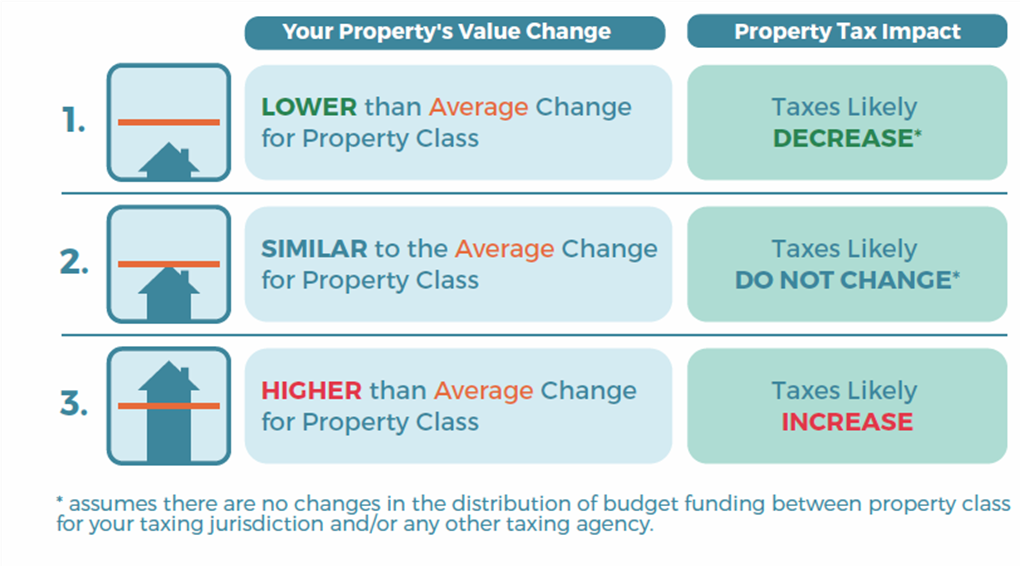

Property Assessments City Of Terrace